E-commerce is rapidly transforming the way we do business, and its potential extends far beyond online shopping. It offers innovative solutions to long-standing challenges, including the persistent credit gap faced by rural communities. By leveraging the power of digital platforms, we can unlock new opportunities for rural entrepreneurs and provide them with the financial tools they need to thrive. This article explores five key ways e-commerce can help bridge the rural credit gap and foster economic inclusion.

Table of Contents

Understanding the Rural Credit Gap

The rural credit gap is a significant barrier to the growth and development of rural economies. It essentially refers to the difference between the financial services that rural populations need and what they actually have access to. This gap impacts individuals and communities who are left without adequate resources to invest in businesses, agriculture, or other essential services like education and healthcare.

Access to credit is crucial for rural areas to thrive, yet many face uphill battles due to a lack of banking infrastructure and traditional financial services. Many financial institutions simply aren’t equipped or willing to serve these remote areas due to perceived risks and costs associated with lending to areas that might not have a strong financial footprint. This leaves a lot of potential untapped and many dreams unfulfilled.

The impact of this credit scarcity extends beyond the individual to the entire community. Without access to loans or credit lines, there’s a struggle to invest in businesses or agricultural ventures. This can stunt economic growth and leave communities dependent on seasonal incomes, limiting their ability to improve their living standards. The cycle of poverty perpetuates as young people migrate to urban areas for opportunities, resulting in a loss of human capital and innovation potential in their hometowns.

A deeper understanding of the rural credit gap isn’t just about knowing the numbers or reports—it’s about empathy. When you understand the worry of a farmer who can’t buy seeds on time or a shopkeeper who dreams of expanding but can’t secure a simple loan, it puts into perspective the critical need for innovative solutions. These stories highlight the urgency of addressing this gap and the role ecommerce might play in bringing new hope and possibilities.

The Rise of Ecommerce in Rural Areas

Ecommerce has been gradually reshaping the landscape of rural communities, opening doors that were once locked tight due to geographical and economic barriers. Across many rural regions, this rise of online marketplaces isn’t just a trend—it’s becoming a cornerstone for local economic transformation.

Several factors contribute to this ecommerce boom. Improved internet access is a game-changer, with more rural residents getting connected and tapping into the digital world. This connectivity brings a plethora of opportunities right to their doorsteps, from job prospects to access to a diverse range of goods and services. Smartphones and better telecommunication infrastructure have also helped foster this growth.

What’s more, these digital marketplaces offer crucial benefits to rural residents. With ecommerce, they can shop for products not available in local stores, often at competitive prices. This access to a wider variety of goods can greatly improve living standards, providing options that were previously unimaginable in remote areas.

Beyond individual consumers, rural businesses are reaping the benefits as well. Selling products online means reaching not just local communities but potential customers nationwide, or even globally. This expanded reach can significantly boost sales and profits for rural entrepreneurs, turning small, local businesses into thriving ventures.

The ecommerce surge isn’t just about the convenience of shopping or selling online. It represents a shift towards inclusivity and empowerment. By leveraging technology, rural areas can now more fully participate in the wider economy, and that’s setting the stage for addressing bigger challenges like the rural credit gap.

#1: Empowering Rural Entrepreneurs via Ecommerce Platforms

Ecommerce platforms can be a tremendous asset for rural entrepreneurs, who often struggle with limited access to traditional markets. These digital spaces level the playing field, making it easier for individuals and small businesses in remote areas to reach customers far beyond their local towns.

One major advantage is the accessibility of online platforms. Whether it’s selling handmade crafts or agricultural products, entrepreneurs can set up shop without the need for brick-and-mortar stores, reducing overhead and entry barriers significantly. This virtual presence allows for scaling operations at a pace that suits the business’s capacity and growth ambitions.

There are numerous success stories of rural businesses that have thrived through ecommerce platforms. For instance, artisans from small villages who once sold their goods at local markets can now cater to customers globally. Their stories serve as powerful examples of how ecommerce can open doors to untapped markets, providing opportunities that seemed unattainable before.

Moreover, ecommerce platforms often go beyond just providing a marketplace. Many offer training programs, workshops, and resources that help rural entrepreneurs develop essential skills in marketing, logistics, and customer relations. This support isn’t just theoretical but rather practical guidance to help entrepreneurs thrive in a competitive digital landscape.

Ecommerce doesn’t just make rural entrepreneurship viable—it can also be a tool for significant economic empowerment. By enabling rural entrepreneurs to succeed, it helps in creating jobs, boosting local economies, and keeping the rural youth engaged and motivated to contribute to their communities instead of migrating to urban areas.

#2: Expanding Financial Inclusivity with Ecommerce

Ecommerce has the potential to significantly enhance financial inclusivity in rural areas, offering solutions that reach beyond the conventional banking systems. One of the most notable ways is through digital financial services which ecommerce platforms are increasingly integrating into their offerings.

These platforms are helping people in rural communities access financial services like digital wallets and online payment methods. By doing so, they contribute to creating an ecosystem where even those without traditional bank accounts can participate in the digital economy. This can be particularly beneficial for unbanked populations, providing them with a way to save and transact securely.

Moreover, digital transactions are proving to be vital in bridging the credit gap, as they create a digital footprint of one’s financial activity. This record can then be used to assess creditworthiness, unlocking the possibility of accessing loans and credit facilities that were previously out of reach for many in rural areas.

Ecommerce companies are already taking initiatives to promote financial inclusivity. For instance, some partner with financial institutions to offer microloans and installment payment options within their platforms. These initiatives not only make purchasing goods more feasible but also help rural buyers build credit histories.

Financial inclusivity through ecommerce isn’t just about adapting to current technologies—it’s about creating a sustainable, ongoing transformation in how rural populations engage with the digital world. By making financial tools accessible, ecommerce is laying down the foundation for long-term economic growth and stability in rural regions.

#3: Innovation in Credit Solutions through Ecommerce

Ecommerce is stepping up as a catalyst for innovative credit solutions, particularly in areas where traditional banking falls short. One approach gaining traction is the introduction of alternative credit options tailored to the unique needs of rural populations.

Microfinancing through ecommerce is one such innovation. By using the platform’s data and customer behaviors, ecommerce companies can offer microloans to small business owners and individuals who might not meet the stringent requirements of traditional banks. This kind of tailored financial support can empower individuals to invest in their businesses and communities.

Fintech collaborations are also playing a pivotal role. These partnerships blend ecommerce’s reach with fintech’s technical capabilities, resulting in creative financial products and services. This might mean the introduction of buy-now-pay-later models or installment plans that make essential purchases more manageable for rural customers.

The influence ecommerce wields in reshaping lending models is significant. Traditional institutions often have rigid frameworks that don’t account for informal earning structures prevalent in rural economies. Ecommerce platforms, on the other hand, have the flexibility to create more inclusive, adaptable solutions.

As ecommerce continues to evolve, its role in providing rural areas with credit solutions is expanding. These innovative credit options are more than just financial tools—they represent a shift towards economic resilience, enabling people in rural areas to invest in their futures with renewed confidence.

#4: Building Trust and Digital Literacy in Rural Communities

Trust plays a crucial role in the adoption of ecommerce in rural communities. Many people are still wary of online transactions, often due to a lack of familiarity with digital platforms. Overcoming this barrier involves cultivating trust and enhancing digital literacy, both of which are essential for fully integrating ecommerce into rural life.

Efforts to boost digital literacy are underway in many areas, providing essential training on how to safely navigate and transact online. Workshops, community programs, and even volunteer initiatives are helping people understand the basics of digital commerce, from setting up accounts to recognizing the signs of online fraud. These skills can empower individuals to participate in the digital economy with confidence.

Ecommerce platforms can contribute significantly to this trust-building process. By implementing secure payment methods and transparent policies, they reassure users of their safety during transactions. Additionally, providing robust customer service and easy return policies can also help build a reliable reputation among rural customers.

Testimonials and success stories are powerful tools in overcoming trust barriers. Hearing relatable experiences from community members who’ve had positive interactions with ecommerce can motivate others to try it themselves. This peer influence can be more effective than any marketing campaign, reinforcing the safety and benefits of engaging with digital commerce.

The journey to building trust and digital literacy is ongoing, but the rewards are substantial. As more rural residents become comfortable online, they unlock new opportunities for personal and economic growth, further closing the credit gap that’s been a persistent hurdle.

#5: Collaborative Strategies with Local Stakeholders

Collaborative strategies between ecommerce companies and local stakeholders are vital in strengthening the impact of ecommerce in rural areas. Partnerships between ecommerce platforms and local governments can facilitate infrastructure development, making sure rural areas have the needed connectivity and logistical support to thrive in the digital age.

Involvement of Non-Governmental Organizations (NGOs) is another key element. NGOs often have deep-rooted connections within communities and can serve as bridges between technology providers and rural residents. By working alongside ecommerce companies, they can identify specific needs and customize solutions that resonate with local populations, ensuring that technological interventions are meaningful and practical.

An essential strategy includes engaging with local artisans and producers. Ecommerce platforms can collaborate with them to create marketplaces for their goods, thus boosting the local economy and encouraging cultural appreciation of handcrafted and regionally unique products. These partnerships help preserve cultural heritage while providing economic opportunities.

By involving these stakeholders, ecommerce initiatives can be more culturally sensitive and economically beneficial. Instead of applying a blanket solution, such collaborations tailor approaches to each community’s needs and strengths. This comprehensive involvement aids in the sustainability of ecommerce growth in rural regions, ultimately contributing to broader economic resilience and development.

Future Prospects: Scaling Ecommerce to Enhance Credit Access

Ecommerce holds great potential for scaling credit access in rural communities. As platforms grow, they can innovate further, tailoring financial products that address the distinct needs of these areas.

Future trends point to increased integration of advanced technologies like artificial intelligence and machine learning. These technologies could enhance credit assessments, allowing for more personalized lending solutions based on accurate data analysis, ultimately leading to fairer access to credit.

Despite these opportunities, several challenges remain. Infrastructure limitations, particularly in isolated regions, still need urgent attention. Consistent internet connectivity and efficient logistics remain key hurdles that must be addressed to ensure all communities can benefit from ebooks commerce growth.

There’s a growing importance for ecommerce platforms to maintain user trust and transparency as they scale. As these platforms handle more sensitive financial data, robust security measures become crucial to protect user information and maintain confidence in digital systems.

Visionary initiatives are already indicating promising developments. Collaboration between ecommerce companies and financial tech firms, as well as continued investment in rural digitization efforts, are setting the stage for a transformative impact. These partnerships are likely to pave the way for a fairer, more inclusive financial landscape in the years ahead.

Conclusion: A Path Towards Economic Equity

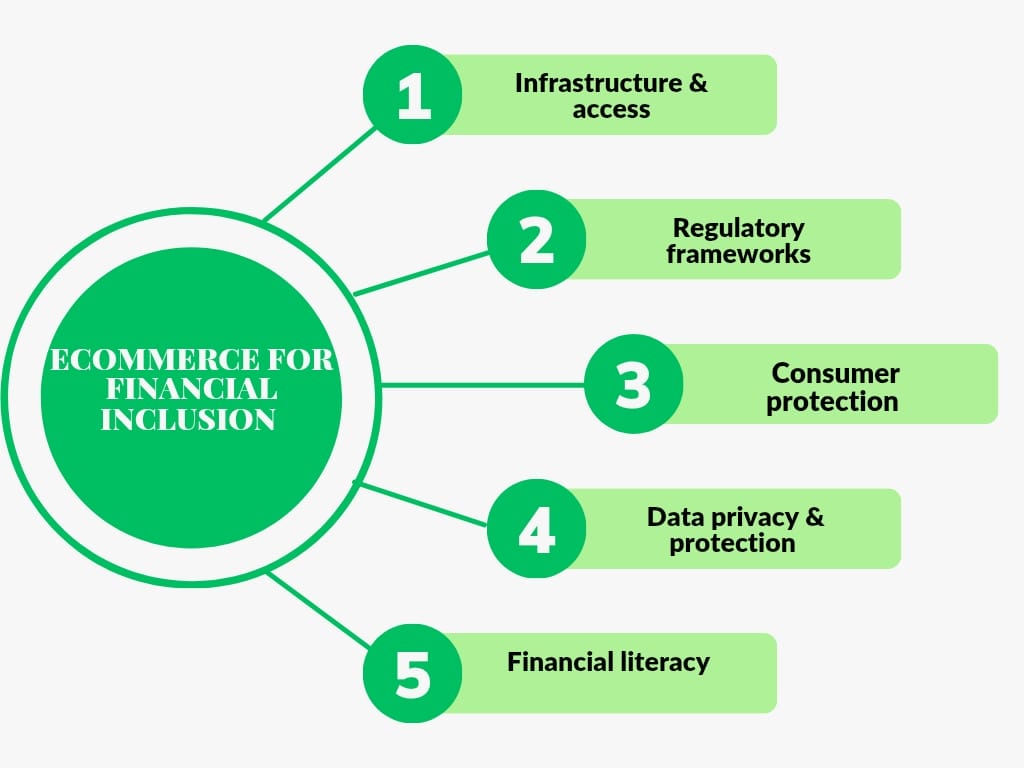

Ecommerce is proving to be a powerful tool in bridging the rural credit gap, offering innovative solutions and opportunities that traditional systems have struggled to provide. By opening new digital avenues, ecommerce can help rural communities access the financial resources they need for growth and sustainability.

This digital transformation is not just about buying and selling; it’s reshaping how credit and financial services reach remote areas. It’s about creating a level playing field where rural entrepreneurs can flourish, rural consumers can access a variety of goods, and financial inclusivity becomes a reality for all.

The journey towards economic equity in rural regions involves multiple stakeholders—from governments to local communities and tech companies. Their collaborative efforts are crucial in building a sustainable ecommerce ecosystem that benefits everyone involved.

By continuing to invest in infrastructure, enhance digital literacy, and develop trustworthy platforms, ecommerce can truly revolutionize the economic landscape for rural areas. This path towards economic equity promises not just growth but also a future where opportunities are accessible to everyone, irrespective of geographical limitations.

Embracing these changes with an innovative spirit and a commitment to inclusiveness can transform rural economies, turning potential into prosperity, dreams into reality, and isolated communities into thriving hubs of economic activity.